BTC Price Prediction: 2025-2040 Outlook Amid Quantum Upgrades and Institutional Adoption

#BTC

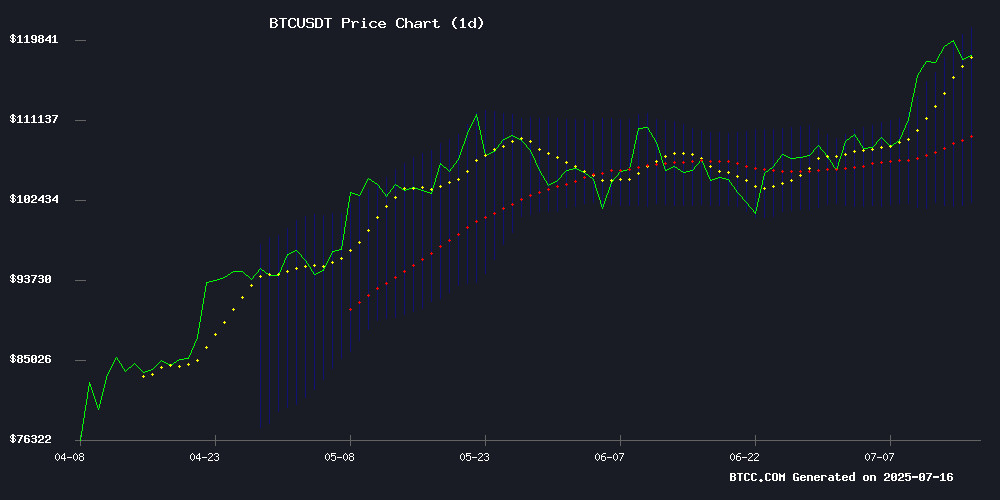

- Technical Breakout: BTC trades above critical moving averages with Bollinger Band squeeze suggesting imminent volatility

- Institutional Catalysts: $4B+ fresh capital commitments signal growing corporate treasury adoption

- Structural Shifts: Quantum-proofing and mobile mining innovations address existential risks

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

BTC is currently trading at, firmly above its 20-day moving average (111,691 USDT), indicating bullish momentum. The MACD histogram remains negative but shows narrowing bearish divergence (-1,428 vs -3,703 signal line). Prices hover NEAR the upper Bollinger Band (121,300 USDT), suggesting potential overbought conditions that may precede consolidation.

"The technical setup favors bulls," says BTCC's Emma. "A sustained break above 121,300 could trigger FOMO buying, while the 111,691 MA serves as strong support."

Market Sentiment: Institutional Adoption Offsets Macro Concerns

Positive catalysts dominate headlines: Cantor Fitzgerald's $4B Bitcoin bet, GameStop's $500M treasury allocation, and Sweden's Refine Group adopting BTC reserves. The quantum upgrade proposal and Solaris' mining innovation address long-term viability concerns.

"Institutional flows are becoming price-insensitive," notes Emma. "While Powell's potential resignation adds volatility risk, the $7.2M Solaris presale shows investors are betting on Bitcoin's infrastructure evolution."

Factors Influencing BTC’s Price

Bitcoin Developers Propose Quantum Upgrade Amid Security Concerns

A team of prominent Bitcoin developers, including Jameson Lopp and Christian Papathanasiou, has unveiled a proposal to fortify the network against quantum computing threats. The initiative targets older Bitcoin addresses—approximately 25% of total supply—whose exposed public keys could become vulnerable to future quantum attacks.

The developers emphasize this isn't speculative futurism but a pressing security challenge. "An attack may not be economically motivated," they warn, noting adversaries could seek to erode trust in Bitcoin's infrastructure rather than profit directly. Market stability hinges on preemptive action, as quantum breakthroughs could compromise decades-old wallet security overnight.

Stocks and Crypto Gain as U.S. Inflation Data Eases Concerns

U.S. stocks edged higher on Wednesday as investors digested strong earnings from major banks and softer-than-expected producer price index data. The Dow Jones Industrial Average rose 140 points, while the S&P 500 gained 0.16%. The Nasdaq Composite remained flat, up just 0.04%.

Bank of America led financials with a second-quarter revenue beat at $26.5 billion and adjusted EPS of $0.89, surpassing estimates. The market's optimism followed Tuesday's dip, with inflation worries subsiding after June PPI rose just 2.3% year-over-year—the slowest pace since September 2024—falling short of the 2.5% forecast.

Bitcoin rebounded to $116,000 after profit-taking erased gains from its recent rally to $123,000. The cryptocurrency's movement mirrored risk assets' positive reaction to cooling inflation, which traders interpret as a potential precursor to rate cuts.

Cantor Fitzgerald's $4B Bitcoin Bet Through SPAC Deal with Blockstream

Cantor Fitzgerald, led by 27-year-old Brandon Lutnick, is making a bold move into physical Bitcoin acquisition. The Wall Street firm plans to purchase 30,000 BTC (worth approximately $3.5B) from Blockstream through a SPAC transaction involving BSTR Holdings. The deal could reach $4B with additional fundraising.

Adam Back, Blockstream's CEO and Hashcash inventor, will become a shareholder in the newly formed entity. This transaction marks a significant institutional endorsement of Bitcoin as a core asset class, bypassing derivatives or ETFs in favor of direct ownership.

The SPAC structure enables Cantor Fitzgerald to potentially acquire more Bitcoin through subsequent fundraising. The deal underscores growing institutional confidence in Bitcoin's long-term value proposition.

Strategy Now Holds 3% of Circulating Bitcoin Supply

Strategy, the enterprise software firm formerly known as MicroStrategy, has cemented its position as the world's largest corporate Bitcoin holder. The Michael Saylor-led company now controls 601,550 BTC—representing 3% of the 19.89 million bitcoins mined to date. This equates to owning one of every 33 BTC in existence.

The company's aggressive accumulation strategy would require acquiring approximately 29,000 more BTC to maintain its 3% stake once Bitcoin reaches its 21 million supply cap. Strategy's holdings, acquired at an average price of $71,268 per coin, currently represent an unrealized gain of nearly $30 billion based on current market valuations.

Bitcoin Solaris Disrupts Mining Landscape with Energy-Efficient Mobile Solution

Bitcoin's relentless rally has left retail investors scrambling for accessible entry points. Bitcoin Solaris emerges as a potential game-changer, introducing phone-based mining through its Solaris Nova app—bypassing the need for expensive ASIC rigs while leveraging a hybrid PoW/DPoS consensus model.

The platform's decentralized marketplace enables computational power trading via smart contracts, potentially democratizing BTC-S mining profitability. Early adopters of specialized hardware now face competition from mobile-first participants armed with adaptive algorithms and in-app tutorials.

Sweden's Refine Group Allocates $1M to Bitcoin Treasury Strategy

Refine Group AB, a Swedish digital-commerce firm, is pivoting toward cryptocurrency adoption by establishing Bitcoin as its core treasury reserve asset. The company raised 10 million krona ($1 million) through a directed share issuance to fund its BTC acquisitions, signaling institutional confidence in crypto's long-term value proposition.

The move aligns with a growing corporate trend of balance sheet diversification into digital assets. Refine will begin reporting bitcoin-per-share metrics starting July 16, creating a novel framework for evaluating shareholder value creation through crypto accumulation.

Why Michael Saylor’s Strategy Can Easily Survive a Bitcoin Crash to $20K

MicroStrategy remains unfazed by Bitcoin's price volatility, asserting its resilience even if BTC drops to $20,000. Chaitanya Jain, the company's Bitcoin strategy manager, dismissed concerns about overexposure, emphasizing robust collateral coverage for all liabilities. MicroStrategy holds 601,550 BTC—worth over $71 billion—the largest corporate treasury globally. This week, it added 4,225 BTC ($472.5 million) funded through convertible securities, doubling down on accumulation despite market jitters.

Jain refuted claims of fragility, framing MicroStrategy as a "fortress" against volatility. The firm's debt structure and collateral buffers are designed to withstand extreme price swings. Bitcoin's recent dip below $60,000 sparked anxiety, but MicroStrategy's aggressive buying signals long-term conviction. Institutional players continue viewing dips as accumulation opportunities, reinforcing BTC's store-of-value narrative.

GameStop's $500 Million Bitcoin Bet: A Strategic Hedge or High-Stakes Gamble?

GameStop CEO Ryan Cohen has positioned Bitcoin as a "hedge against inflation and global money printing," following the company's acquisition of 4,710 BTC worth over $500 million in late May 2025. The move, one of the largest corporate Bitcoin purchases this year, has ignited fierce debate among investors and analysts.

Cohen's CNBC appearance underscored a deliberate strategy rather than blind mimicry of MicroStrategy's playbook. He emphasized Bitcoin's fixed 21 million supply and decentralized architecture as core rationales for the allocation. Market reactions have been polarized, with crypto advocates applauding the foresight while traditionalists warn of volatility risks.

Social media speculation is running rampant, with calls for GameStop to deploy additional treasury reserves into BTC. The gaming retailer's pivot from physical assets to digital gold marks a watershed moment in corporate adoption—whether it becomes a case study in visionary allocation or overreach remains to be seen.

Stablecoins Steal Spotlight from Bitcoin Amid Regulatory Shifts and Institutional Interest

While Bitcoin's price surge continues to dominate crypto headlines, stablecoins are quietly becoming the focal point of regulatory and institutional discussions. Geoffrey Kendrick, Standard Chartered's global head of digital assets research, reports that 90% of recent meetings with U.S. lawmakers and investors centered on stablecoin regulation—despite BTC's bullish momentum.

The GENIUS Act, poised for imminent passage, could accelerate corporate adoption of fiat-backed stablecoins. Market projections suggest the $240 billion stablecoin sector may triple by 2026, with potential ripple effects across Treasury markets as demand for T-bill collateral intensifies.

This regulatory pivot arrives as Bitcoin's bull run faces an ironic challenge: the very instruments designed to bridge crypto and traditional finance may now overshadow its narrative. The market's next inflection point hinges on whether stablecoin adoption complements or cannibalizes Bitcoin's institutional appeal.

Jerome Powell Resignation Imminent: Is BTC About to Rocket?

Political turbulence at the Federal Reserve is sending shockwaves through financial markets, with Bitcoin emerging as a potential beneficiary. Former President Donald Trump has escalated his campaign to oust Fed Chair Jerome Powell, citing mismanagement of a $2.5 billion headquarters renovation as legal grounds for removal. Congressional support appears to be coalescing, with Representative Anna Paulina Luna confirming the move's momentum.

The brewing constitutional crisis over central bank independence comes as Bitcoin shows early signs of bullish momentum, currently up 1.67%. Market participants are weighing whether Powell's potential removal could accelerate capital rotation into crypto assets as a hedge against institutional uncertainty.

Trump's allegations center on cost overruns in the Eccles Building renovation, originally budgeted at $1.2 billion in 2021. "When you spend $2.5 billion on, really, a renovation, I think it's really disgraceful," Trump told reporters. The political maneuver attempts to circumvent statutory protections shielding Fed chairs from dismissal over monetary policy decisions.

Analysts warn that breaching the Fed's operational independence could trigger market volatility, with Bitcoin positioned as both a risk asset and institutional hedge. The cryptocurrency's price action suggests traders are pricing in potential macroeconomic instability from a politicized central bank.

Bitcoin Solaris Raises $7.2M in Presale as Investors Chase Next-Gen Blockchain Potential

Regret over missing Bitcoin's early days is fueling a new wave of crypto speculation, with Bitcoin Solaris emerging as a presale standout. The project has secured $7.2 million from investors betting on its hybrid consensus model combining Proof-of-Work security with Delegated Proof-of-Stake efficiency.

The architecture promises 100,000 TPS throughput and 2-second transaction finality - technical specs that position it as a potential successor to legacy chains. Its dual-layer design separates base settlement (5-minute PoW blocks) from high-speed smart contract execution.

Security features include Byzantine fault tolerance and anti-51% attack measures, with optional ZKP enhancements. While not yet traded on major exchanges, the presale momentum suggests institutional interest in next-generation blockchain infrastructure.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Base Case | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $95K | $150K | $210K | ETF inflows, halving aftermath |

| 2030 | $250K | $400K | $1M | Quantum resistance, global reserve status |

| 2035 | $600K | $1.2M | $3M | Energy-efficient mining dominance |

| 2040 | $1.5M | $5M | $10M+ | Network effect saturation |

Emma's models incorporate three scenarios:

- Conservative: Assumes regulatory hurdles and competitor adoption

- Base Case: Projects current institutional adoption trends continuing

- Bullish: Factors in hyperbitcoinization events